modified business tax rate nevada

Modified business tax nevada due date. Additionally the new threshold is decreased from 85000 to 50000 per quarter.

State Of Nevada Department Of Taxation Ppt Video Online Download

If the sum of all taxable wages after health.

. 8 20th SS at 070 of quarterly taxable wages from October 1. A Nevada Employer is defined as per NRS 363B030. It is assessed if taxable wages exceed 62500 in a quarter.

Nevada Tax - File Pay. Impounding and filing of the Nevada Business Tax is now supported. This is the standard quarterly return for reporting the Modified Business Tax for General Businesses.

7500 25 Of the amount over 50000. Live Entertainment Tax Forms. If your taxable wages fall under 62500 then you do not pay the MBT.

13750 34 Of the amount over 75000. Marginal Corporate Income Tax Rate. Since the 2nd quarter of 2013 paper tax returns under the codes of NVGBT and NVFBT have also been.

Sales Use Tax Forms. Modified Business Tax NRS 463370 Gaming License Fees NRS 680B Insurance Fees and Taxes. The current MBT rate is 117 percent.

The MBT rate is 117 percent. If you have any. General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages after deduction of health benefits paid by the employer and certain wages paid to qualified veterans.

Henderson Nevada 89074 Phone. Nevada levies a Modified Business Tax MBT on payroll wages. If the sum of all wages for the 915 quarter.

Nevadas corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Nevada. Imposition - A excise tax at the rate of 2 of the wages paid by the employer during a calendar quarter. The Department is developing a plan to reduce the Modified Business Tax rate for quarters ending September 31 2019 through March 31 2021 and will be announcing when refunds will be issued soon.

If you are doing business in multiple states the business may have nexus with those states. Modified Business Tax Forms. The new Modified Business Tax rates for FY20 as calculated pursuant to NRS 360203 are 1378for general business and 1853 for mining and financial institutions.

If the taxable wages are 62500 or less no MBT is due. Fiscal Year 2020 Tax Rates Forecast Actual Difference Difference Tax Rates Modified Business Tax 1475 general business. The new law imposes a 1475 MBT after July 1 2015 and lowers the exemption to 50000 per quarter.

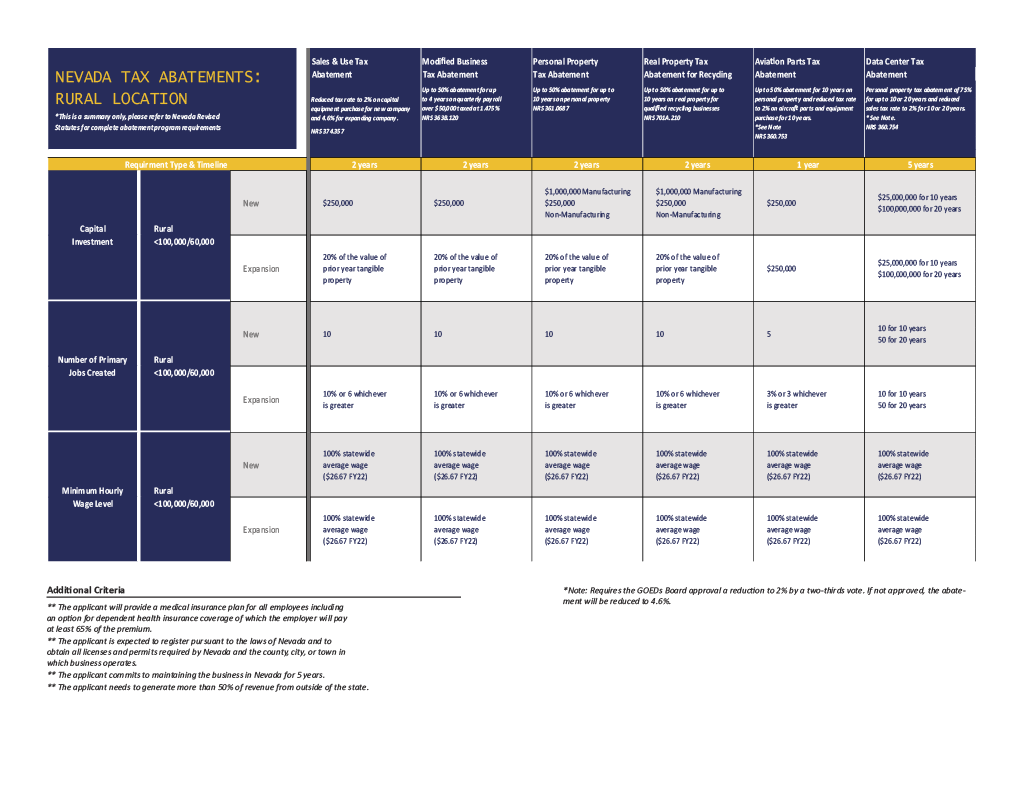

31 2019 through March 31 2021 for general business financial institutions. Wednesday March 30 2022. Qualifying employers are able to apply for an abatement of 50 percent of the tax due during the initial four years of its operations.

Nevada Modified Business Tax Return. The payroll tax missed that mark by one vote passing 13-8 with all Republicans opposed. The tax rate for non-financial businesses under the MBT-NFI was initially established in SB.

The modified business tax is described by the Nevada Department of Taxation as a quarterly payroll tax. The Modified Business Tax MBT was established in Senate Bill 8 of the 20th Special Session in 2003 beginning in FY 2004 with an October 1 2003 effective date. Nevada Modified Business Tax Rate.

However the first 50000 of gross wages is not taxable. The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries such as financial institutions paid a higher rate. Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165.

For a new business the abatement of the Modified Business Tax applies to the number of new employees. 702 486-3377 MODIFIED BUSINESS TAX REFUND NOTICE Dear Taxpayer During the 2019 Legislative Session Senate Bill 551 was passed which repealed the biennial Modified Business Tax rate adjustment. The Nevada Supreme Court recently held that a Nevada law that repealed a previously legislated reduction of the Modified Business Tax MBT rate was unconstitutionally enacted.

The Department of Taxation confirmed it is developing a plan to reduce the Modified Business Tax rate for quarters ending Sept. And when it comes to taxes on Nevada businesses Wilcox said most companies will not see any tax rate increases for the next two years. SALT Report 3089 The Nevada Department of Taxation is advising taxpayers that the September 30 2013 modified business tax returns were printed with the old 62500.

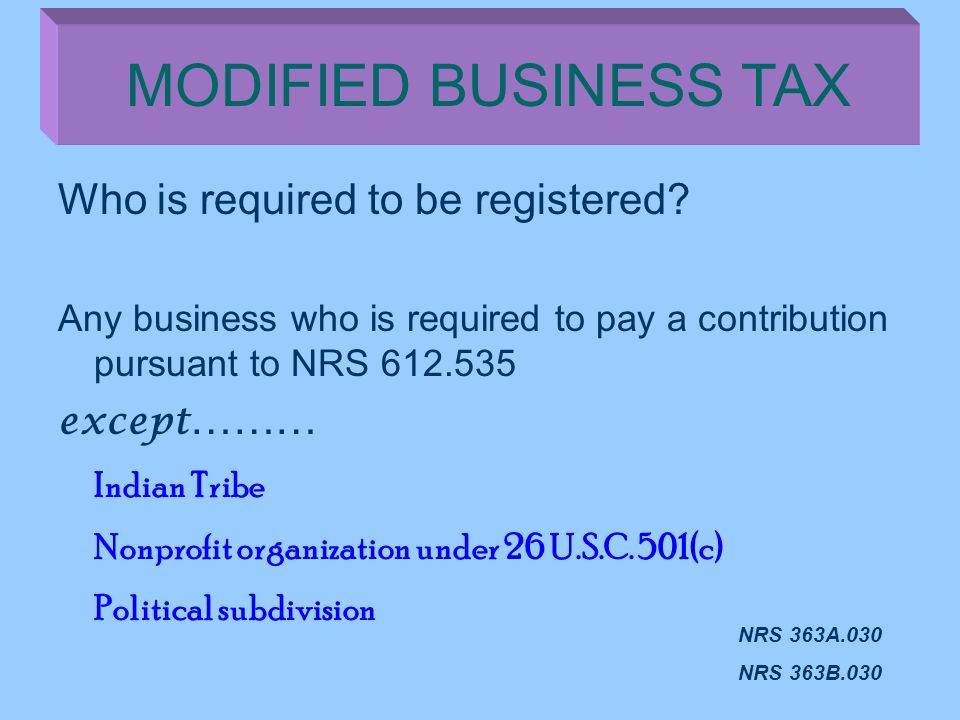

NVFBT Financial Institutions Business Tax. Taxpayers may update their address using Nevada Online Tax or by contacting the Departments Call Center at 1-866-962-3707. In general every employer that is subject to payment of Nevada unemployment tax is also subject to the MBT which is imposed on total gross wages less employee health.

The default dates for submission are April 30 July 31 October 31 and January 31. Nevada Revised Statute 363B120 provides an abatement of the Modified Business Tax for qualifying businesses. On May 13 2021 the Nevada Supreme Court upheld a decision that Senate Bill 551 was unconstitutional.

The modified business tax MBT is considered a payroll tax based on the amount of wages paid out in a quarter. NVGBT General Business Tax. Gold and Silver Excise Tax.

SB 483 of the 2015 Legislative Session became effective July 1 2015 and changes the tax rate to 1475 from 117. The following tax codes create transfers and liability records. For additional questions about the Nevada Modified Business Tax see the following page from the State of Nevadas Department of Taxation.

The high court ruled unanimously on Thursday that Senate Democrats vote to extend the Modified Business Tax sunset for another two years in 2019 was unconstitutional since it failed to win a two-thirds majority. If your business has taxable wages that exceed 62500 in a quarter then the MBT is applied.

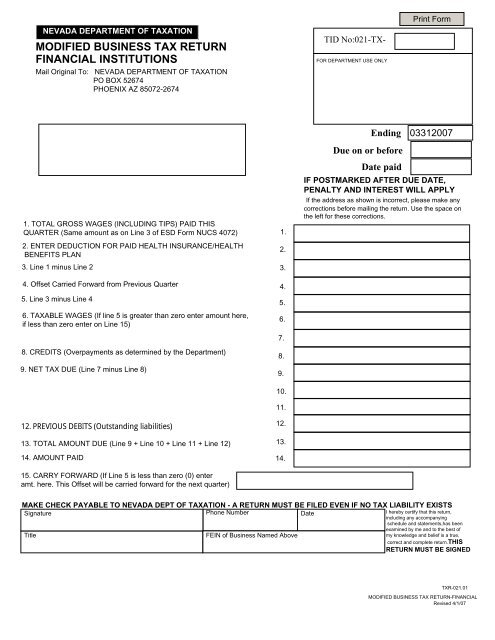

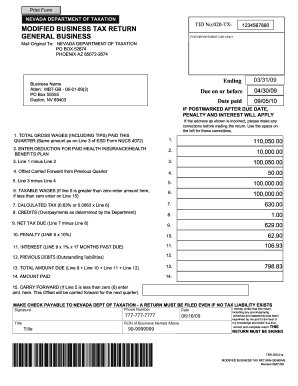

Modified Business Tax Return Financial Institutions

Modified Business Tax Return Financial Institutions

Slt Nevada S New Tax Revenue Plan The Cpa Journal

Does Qb Offer The Nv Modified Business Tax Payroll Form

2014 2022 Form Mt Ui 5 Fill Online Printable Fillable Blank Pdffiller

What Is The Business Tax Rate In Nevada

State Of Nevada Department Of Taxation Ppt Video Online Download

Business Friendly Nevada Northern Nevada Development Authority

What Corporate Taxes Do Businesses Pay In Nevada Llb Cpa

How To Form An Llc In Nevada Llc Filing Nv Swyft Filings

State Of Nevada Department Of Taxation Ppt Video Online Download